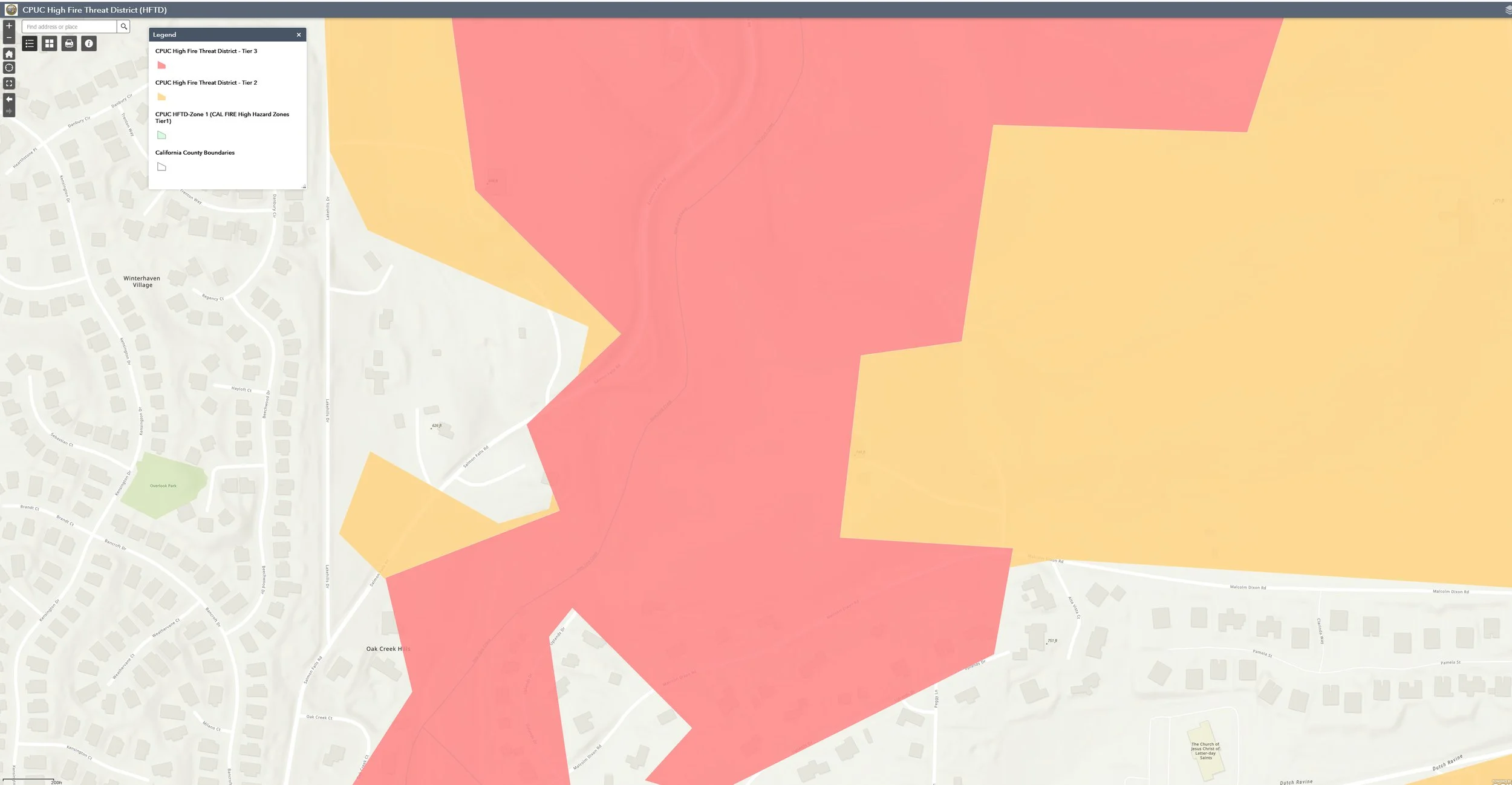

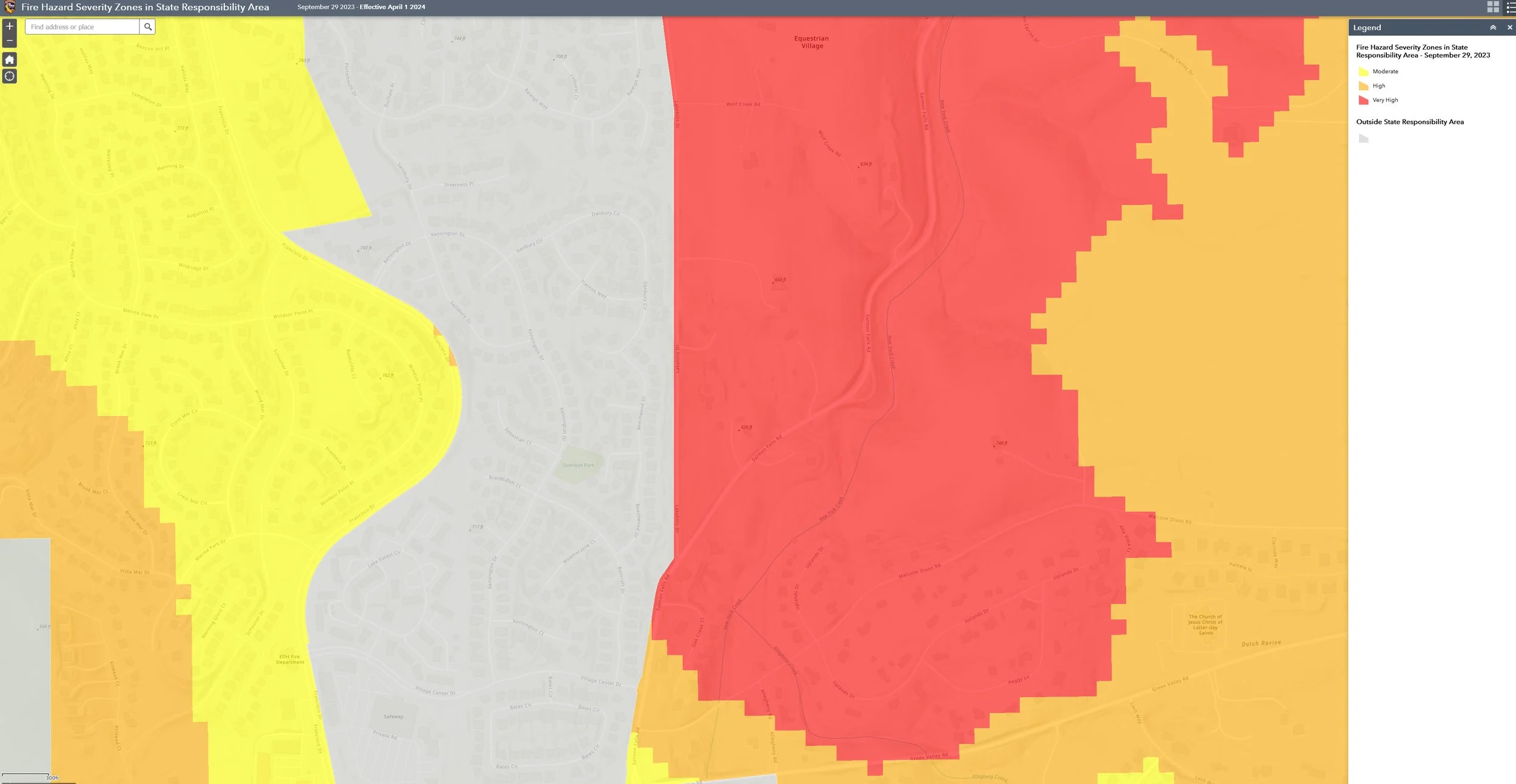

With insurance companies and county governments enacting stricter standards for homes due to a risk of fire, it’s helpful as a buyer to understand where there is more risk vs. less prior to making an offer to purchase a home. Alternatively, a buyer will find out during escrow via a Natural Hazard Disclosure Report, however that process can take a week and a buyer may incur costs during that period such as inspections and/or appraisal. Plus, if the buyer does elect to cancel escrow as a result of a higher fire risk finding then that buyer may lose their interest rate lock which in an escalating interest rate environment, could be costly.

When I work with a buyer fire risk maps are provided for homes which we view.